Senior Loan Refinancing: A Comprehensive Guide

Introduction

Refinancing is one of the personal finance endeavors with the greatest potential for cost savings and financial empowerment. Among the different renegotiating choices accessible to mortgage holders, senior Loan Refinancing stands apart as an integral asset for opening value, diminishing regularly scheduled installments, and improving monetary security. In this complete aide, we’ll dive into the complexities of senior advance renegotiating, investigating its definition, benefits, qualification models, cycle, and key contemplations.

Grasping Senior Credit Refinancing

Senior Loan Refinancing includes supplanting a current senior advance with another advance, ordinarily with additional ideal terms. The expression “senior credit” regularly alludes to the essential home loan on a property, instead of subordinate credits like home value credit extensions (HELOCs) or second home loans. By renegotiating their senior credit, mortgage holders expect to get better financing costs, broaden or abbreviate the advance term, change their regularly scheduled installments, or access value restricted in their homes.

Advantages of Senior Credit Refinancing

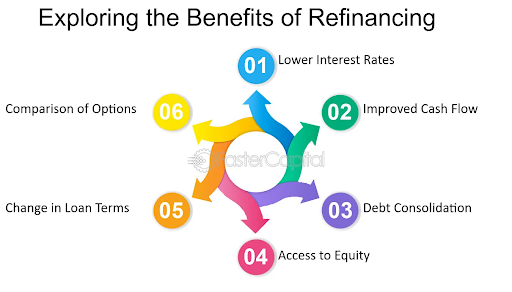

The choice to renegotiate a senior credit can yield a bunch of advantages, including:

1. Lower Revenue Rates:

One of the most well-known inspirations for renegotiating is to gain by lower loan costs. By protecting another credit with a lower financing cost than the first, property holders might possibly save many dollars over the existence of the advance.

2. Decreased Regularly scheduled Payments:

Renegotiating can prompt lower month to month contract installments, which can ease monetary strain and further develop income. This can be especially favorable during times of monetary vulnerability or when confronted with startling costs.

3. Admittance to Equity:

With a cash-out refinance, homeowners can use the equity they’ve built up in their homes. This enables them to reach a single amount, which can be used for home improvements, obligation consolidation, educational expenses, or other monetary goals.

4. Obligation Consolidation:

Renegotiating gives a potential chance to merge exorbitant premium obligation, for example, Mastercard adjusts or individual credits, into a solitary, more reasonable advance with a lower financing cost.

5. Further developed Credit Terms:

Borrowers can fit the particulars of the new credit to all the more likely suit their monetary goals, whether it’s shortening the advance term to take care of the home loan sooner or stretching out the term to diminish regularly scheduled installments. Read More: binbex

Qualification Criteria

While the particular qualification measures for senior Loan Refinancing may shift relying upon the bank and advance program, a few normal considers commonly come play:

1. Credit Score:

Moneylenders regularly require a base FICO rating to fit the bill for renegotiating. A higher financial assessment frequently means better credit terms, including lower loan fees.

2. Pay and Employment:

Borrowers should exhibit adequate pay to help the new advance installments. Moneylenders might demand pay nails, expense forms, or other documentation to check pay solidness.

3. Value in the Property:

Banks commonly require a base measure of value in the property to fit the bill for renegotiating. The credit-to-esteem (LTV) proportion, which looks at the credit add up to the property’s evaluated esteem, assumes a significant part in deciding qualification.

4. Outstanding debt compared to revenue Ratio:

Loan specialists evaluate borrowers’ outstanding debt compared to revenue (DTI) proportion, which analyzes their month to month obligation commitments to their gross month to month pay. A lower DTI proportion demonstrates a lower hazard of default and may further develop qualification for renegotiating.

5. Property Appraisal:

Moneylenders might require another examination of the property to decide its ongoing worth. The evaluation lays out the property’s value and guarantees that the credit sum lines up with the property’s worth.

The Renegotiating Process

The course of senior advance renegotiating ordinarily includes a few stages:

1. Surveying Monetary Goals:

Prior to starting the renegotiating system, mortgage holders ought to assess their monetary targets and decide if renegotiating lines up with their objectives. This includes considering variables, for example, financing costs, credit terms, and expected reserve funds.

2. Gathering Documentation:

Borrowers should assemble the fundamental documentation to help their renegotiating application. This might incorporate ongoing compensation hits, assessment forms, bank explanations, and confirmation of mortgage holders protection.

3. Looking for Lenders:

To find the best renegotiating bargain, property holders ought to search around and analyze offers from various moneylenders. This permits them to assess different credit terms, loan fees, and shutting expenses to recognize the most beneficial choice.

4. Presenting an Application:

Whenever borrowers have picked a moneylender, they can present a renegotiating application. The application cycle ordinarily includes giving individual and monetary data, approving a credit check, and consenting to a property examination.

5. Guaranteeing and Approval:

The bank conducts a comprehensive review of the borrower’s financial profile, record of advance reimbursement, and property assessment after receiving the reconsidering application. If the borrower meets the loan specialist’s qualification requirements, the credit moves to the guaranteeing stage for final approval.

6. Shutting the Loan:

The borrower goes to an end meeting to sign the important desk work and close the renegotiating exchange after the credit has been supported. During the closing process, borrowers may be required to pay closing costs like loan origination fees, appraisal fees, title search fees, and other administrative costs.

7. Dispensing of Funds:

In the wake of shutting, the bank dispenses the assets to take care of the current credit, and the new advance produces results. Borrowers start making installments as per the terms framed in the renegotiating arrangement.

Key Considerations

Prior to continuing with senior advance renegotiating, mortgage holders ought to painstakingly think about the accompanying variables:

1. Shutting Costs:

Renegotiating commonly brings about shutting costs, which can add up to huge number of dollars. When making a decision, you must take these costs into account and decide if the potential savings are worth the initial cost.

2. Equal the initial investment Point:

Ascertaining the make back the initial investment point assists property holders with deciding what amount of time it will require to recover the expenses of renegotiating through lower regularly scheduled installments or premium reserve funds. If the make back the initial investment point stretches out past the expected time in the home, renegotiating may not be monetarily worthwhile.

3. Influence On layaway Score:

Applying for renegotiating can briefly bring down a borrower’s FICO rating because of the credit request and the new advance record. Be that as it may, the drawn out advantages of renegotiating, for example, lower loan fees and paid off past commitments trouble, can at last further develop financial soundness after some time.

4. Prepayment Penalties:

Renegotiating or early reimbursement of a few existing credits might bring about prepayment punishments. While choosing whether or not to renegotiate, borrowers ought to investigate the conditions of their ongoing credits to check whether there are any prepayment punishments that apply.

5. Future Loan fee Trends:

Expecting future loan fee patterns can assist mortgage holders with deciding the ideal timing for renegotiating. Assuming that loan fees are supposed to diminish further, it could be worthwhile to stand by prior to renegotiating to get an even lower rate.

6. Options in contrast to Refinancing:

At times, options in contrast to renegotiating, like credit change or renegotiation, may offer comparative advantages without the requirement for another advance. Property holders ought to investigate every single accessible choice and talk with a monetary counsel to decide the best game-plan.

Conclusion:

Refinancing a senior loan offers homeowners a valuable chance to improve their mortgage terms, lessen their financial burden, and achieve their long-term financial objectives. Via cautiously assessing what is going on, investigating accessible choices, and taking into account key factors, for example, loan fees, shutting expenses, and qualification models, borrowers can settle on informed choices that lead to more noteworthy monetary steadiness and security. Whether looking to month to month lower installments, access value, or merge obligation, senior Loan Refinancing can act as an amazing asset for opening the maximum capacity of homeownership and building a more splendid monetary future.